Tax return depreciation calculator

Depreciation on buildings Depreciation was allowed on most buildings until 2010 and for the 2012 2020 income years the depreciation rate for buildings with an estimated life of more than 50 years was set at zero. Let Tim submit your tax return direct to SARS in just a few clicks.

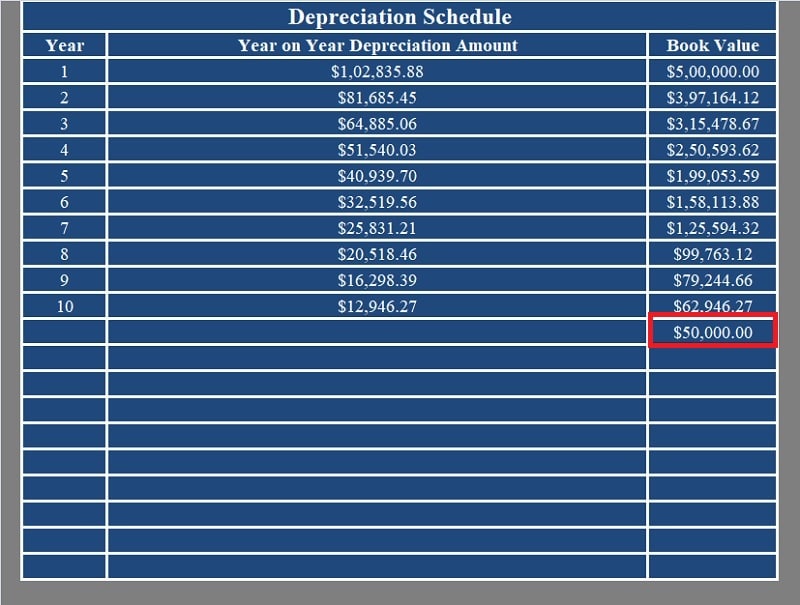

Download Depreciation Calculator Excel Template Exceldatapro

1 lakh and 80 depreciation is prescribed for the asset and you charge only rs.

. Do Your Tax Return Easily Avoid penalties Maximise your refund Tim uses your answers to complete your income tax return instantly and professionally with everything filled in in the right place. Anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. We set depreciation rates based on the cost and useful life of assets.

A tax depreciation schedule outlines all available depreciation deductions to maximise the cash return from your investment property or business each financial year. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed. The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 202223.

A tax depreciation schedule outlines all available depreciation deductions to maximise the cash return from your investment property or business each financial year. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. For eg if an asset is of Rs.

Depreciation can be claimed at lower rate as per income tax act. Tax depreciation estimates Your investment property might hold thousands of dollars in tax deductions. The ATO only accepts tax.

Accelerating depreciation with bonus depreciation Ushered in with the Tax Cuts and Jobs Act bonus depreciation makes it possible to claim 100 of the cost of any machinery and equipment purchased. DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne. Cost of Rs 150 less cumulative tax depreciation of Rs 90 ie.

Consequently the entity will pay income taxes of Rs 10 Rs 40 at 25 when it recovers the carrying amount of the asset. Car Depreciation Calculator. Our tool is renowned for its accuracy and provides usable.

That is completely incorrect - leo07 cannot simply amend the last three years tax returns to claim the foregone depreciation deductions because leo07 adopted an impermissible method of accounting on the first tax return and then used the same impermissible method in two actually more than two consecutively filed tax returns. Unfortunately the same auto limits that apply to Section 179 also apply to bonus the max deduction is 18200 in the first year. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000.

Let Tim submit your tax return direct to SARS in just a few clicks. Do Your Tax Return Easily Avoid penalties Maximise your refund Tim uses your answers to complete your income tax return instantly and professionally with everything filled in in the right place. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

To recover the carrying amount of Rs 100 the entity must earn taxable income of Rs 100 but will only be able to deduct tax depreciation of Rs 60. 30000 as depreciation in this case next year wdv will be. Capital works constitute the real investment and should be kept in a well-maintained state of repair for maximum return later at the disposal date.

Depreciation rates Assets are depreciated at different rates. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

20222023 Federal and State Income Tax Salary Calculator.

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Depreciation Formula Calculate Depreciation Expense

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Irs Publication 946

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Macrs Youtube

Depreciation Formula Examples With Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

Guide To The Macrs Depreciation Method Chamber Of Commerce

Download Depreciation Calculator Excel Template Exceldatapro